24+ tax savings on mortgage

Get Your VA Loan. Now is as good a time as any.

Mortgage Interest Deduction A Guide Rocket Mortgage

Web Supposing that your top marginal tax rate is 32 percent the deduction will save you 5120 on your taxes 32 percent of 16000.

. Trusted VA Loan Lender of 300000 Veterans Nationwide. Any interest paid on. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as much.

The Las Vegas sales tax rate is 8375 in 2022. 15 year fixed. Web Tax Guide.

Web What Is The Sales Tax In Las Vegas. The interest paid on a mortgage along with any points. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

Web Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is 500000 if married and filing separately. Web What are the tax savings generated by my mortgage. Ad VA Loan Expertise Personal Service.

You filed an IRS form 1040 and itemized your deductions. If youre single you should. Web 1 hour agoThe Kenya Mortgage Refinance Company says the average size of home loans it refinanced last year went up 2778 percent to Sh299 million from Sh234 million.

Web The Mortgage Credit Certificate aka MCC program provides qualified homebuyers with income tax savings of up to 20 of the interest paid on their mortgage loan. Contact a Loan Specialist. Web You may deduct the interest you pay on mortgage debt up to 750000 375000 if married filing separately on your primary home and a second home.

30 yr fixed mtg refi. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. The State of Nevada sales tax rate is 46 added to the Clark County.

Web Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. Fast VA Loan Preapproval. Web Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is 500000 if married and filing separately.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Any interest paid on. Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements.

Compare Apply Directly Online. With the interest on a mortgage being deductible when you itemize deductions it may surprise you how much you can. Web The Mortgage Credit Certificate MCC program provides qualified homebuyers with an annual federal income tax credit equal to roughly 20 of the mortgage interest paid.

Mortgage Specialist Resume Examples Samples For 2023

What Is Section 24 Common Questions About Mortgage Interest Tax Relief Restrictions Less Tax For Landlords

Deduction Of Interest On Housing Loan Section 24b Taxadda

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Financial Access Under The Microscope1 In Imf Working Papers Volume 2018 Issue 208 2018

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Tax Deduction What You Need To Know

Fannie Mae And Freddie Mac Will Require The Use Of Fico Score 10 T

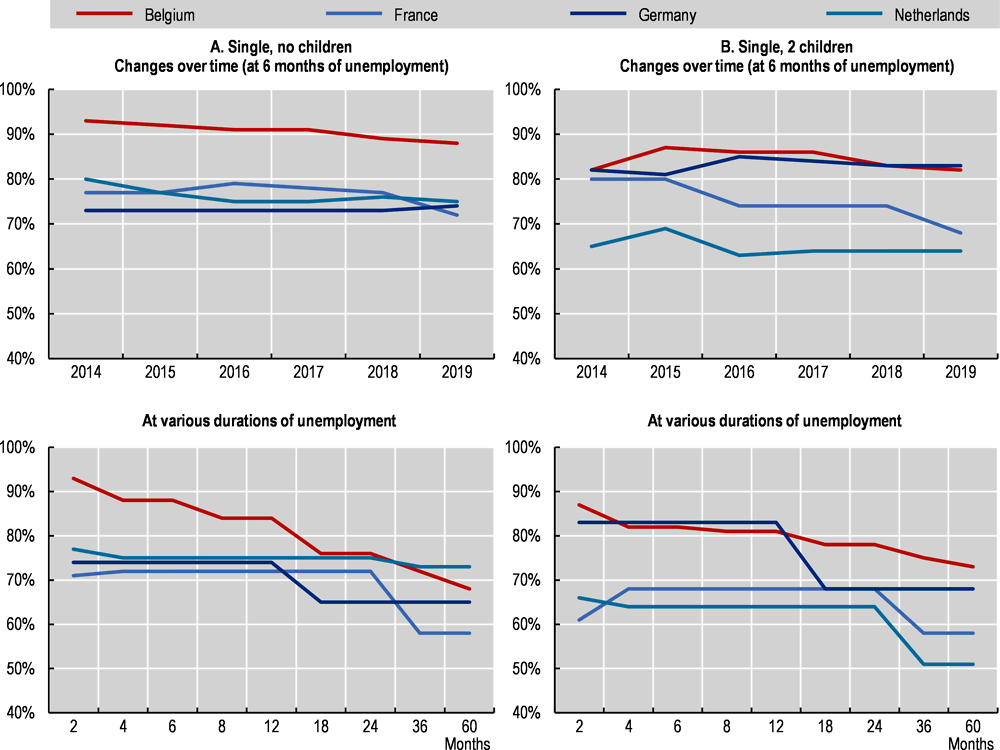

The Role Of Policy And Institutions The Future For Low Educated Workers In Belgium Oecd Ilibrary

Key Questions Answered

Mortgage Interest Deduction How It Calculate Tax Savings

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Tax Deduction Calculator Homesite Mortgage

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Delegated Underwriting Training Ppt Download